Update on Offshore drillers

Jumping into the markets, it was a long week of earnings throughout some of our themes, e.g. Florida migration and Oil Services, both of which seem to be trending in the right direction, albeit slowly. Offshore drillers in particular had a sleepy 2H23, where contract awards slowed and seemingly every operator had a handful of…

Our newest inflecting theme – RoRo

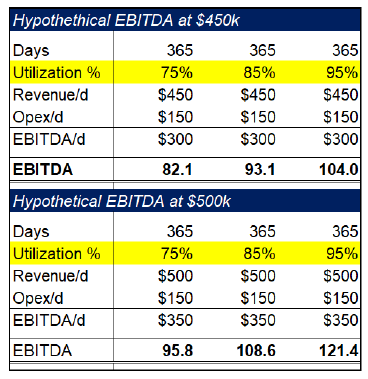

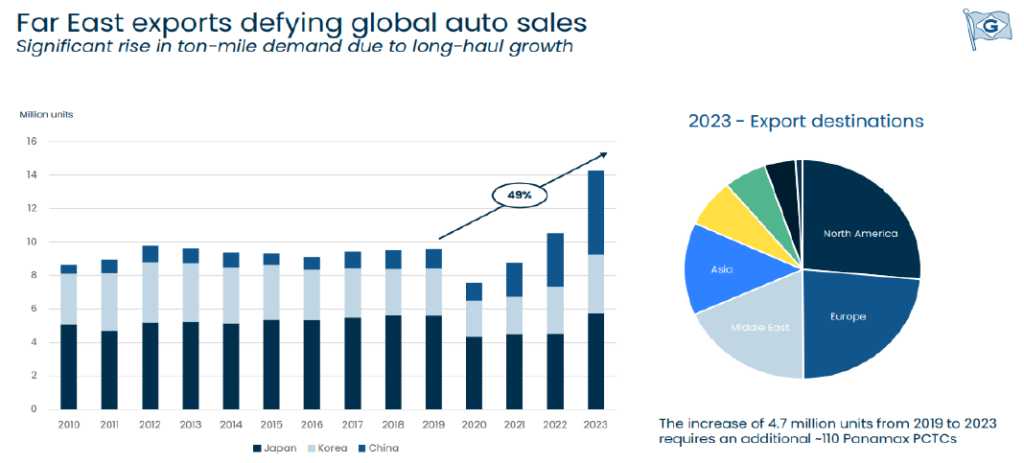

Turning to our newest theme, RoRos, earnings got rolling with a focus on the current progress of contract renewals, mitigating Red Sea disruptions and meaningful changes in capital allocation strategies. RORO Index…No, this isn’t SMCI. Current market rates hit a new record-high in January, with HAUTO reporting net rates of $85.40/cbm. Both HAUTO and WAWI…

Eiffel Towers and “Tons of Liquidity”

Turning to the market for a quickie, it sure feels like we’re living through a fever dream here… Yes, the RRP is gushing liquidity everywhere… Yes, the economy is booming… Yes, the inflation is accelerating… Yes, Fiscal is gonna be like 8% of GDP in 2024 (elections need stimmies)… …and amazingly, the Fed is talking…

More on Stock Buybacks…

We are still digging out from earnings and prepping for another onslaught next week in some of our themes. But one theme that keeps pinging as we peruse the conference calls so far is the overall trend in buybacks (at least in our “old economy” themes and stocks). We noted a few weeks back that…

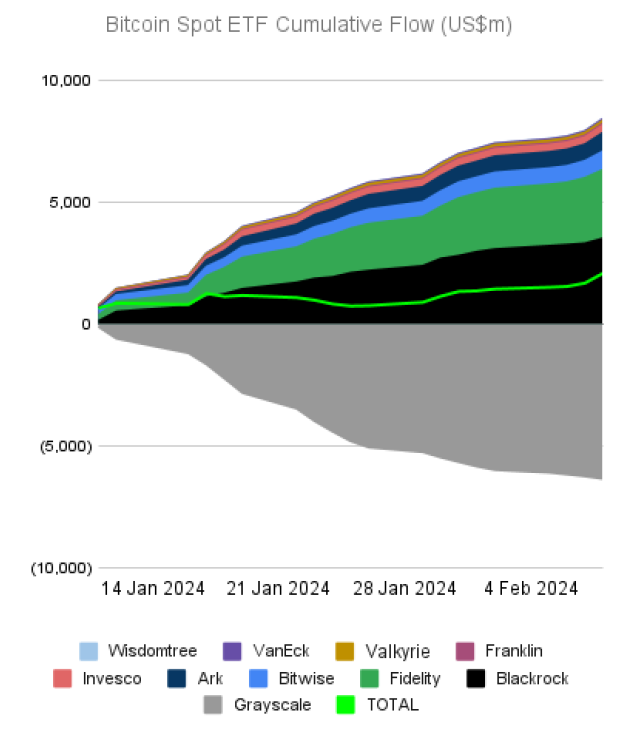

Bitcoin Flows

And since we are on the topic of passive flows and reflexivity, we figured we’d note the massive passive flows picking up in BTC-linked ETFs. Front-running ETF-like flows has been a recurring theme in KEDM back in 2020 with GBTC (BTC) and again in 2021 with SPUT (uranium). This time we come back to well…

Happy Hour “Shipping” – Charles from Marhlem

We want to thank Charles from Marhlem for hopping on Friday’s Happy Hour for a tour de force of the shipping industry. We bounced around the entire shipping industry from RoRos to tankers. We even pulled a few tickers out of him that are worth exploring. As always, we jotted down some high level Kliff…

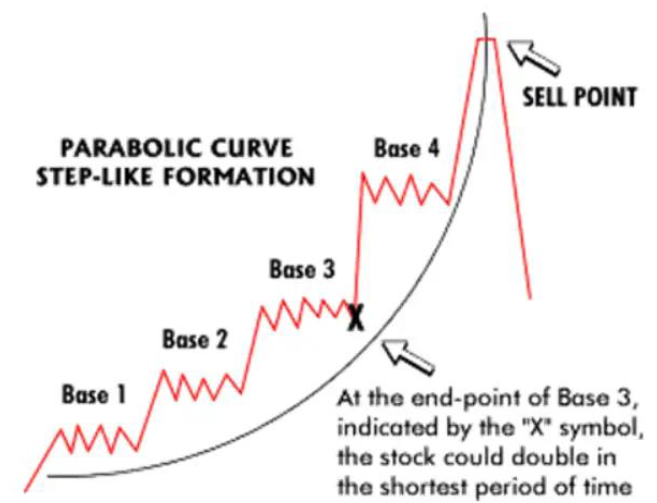

Where are we with Uranium hitting triple digits?

Shifting topics a bit, with Uranium hitting triple digits, we would of course, be remiss if we didn’t mention it (yet again). Let’s talk about parabolas… Which base are we in?? The one where utilities finally say “fukit!! git sum!!” and machine gun the offer… Look, there are a number of public RFPs out there…

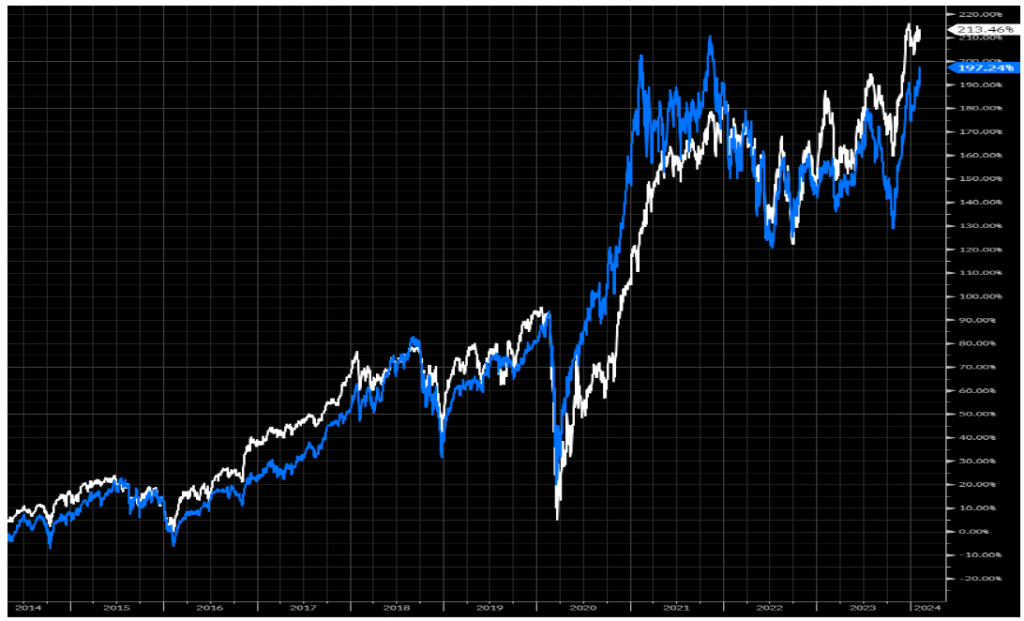

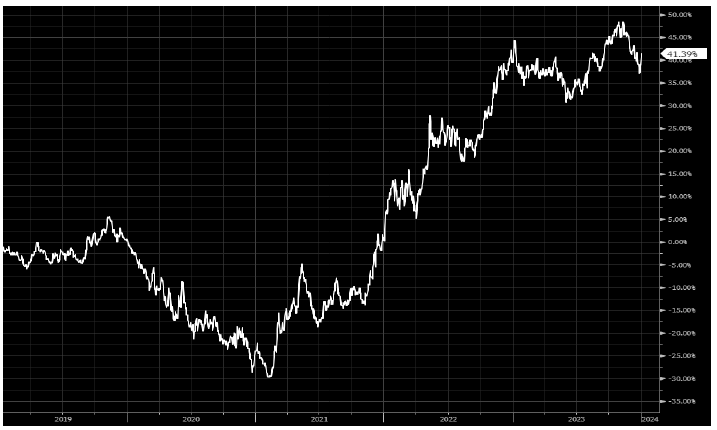

Event-Driven trading: Why stock buybacks?

With our resolutions out of the way, lets spend a bit of time chatting buybacks since they have been the massive factor outperformer in the past few years. See chart below using Russell as the underlying universe: As inflection investors, we are often presented with two scenarios 1) industries that have been left for dead…